Top Wine Trends for 2023

The wine industry, like nearly every other food, beverage, and hospitality industry, has been navigating a dynamic landscape over the past few years. From the lingering impacts of COVID to the ever-evolving preferences of younger consumers and the rise of “better for you” trends, wine suppliers and distributors face a multitude of challenges to stay relevant and keep up with the market.

However, amidst these obstacles lie promising opportunities for growth and innovation. Suppliers and distributors have recognized the power of premiumization—capitalizing on the desire for elevated experiences and refined tastes. Additionally, the emergence of new and convenient products is reigniting the interest in the wine category. In this blog, we explore the strategies and trends that will help industry players uncork their potential, embrace the evolving consumer demands, and seize the opportunities that lie ahead.

A Drink for the Ages

It’s widely acknowledged that Gen Z and Millenials are drinking less in general, but one category where they’re noticeably absent is wine.

In the past, new drinkers would enter the wine market with affordable, mass-produced starter wines. Today’s young consumers, however, have access to a multitude of new and well-made products. They can now opt for craft and high-quality seltzers or cocktails, often at a price point lower than a wine of the same caliber.

While some suppliers are trying to counter this phenomenon by adding new products to their portfolios, other winemakers are accepting their fate and opting for a different strategy altogether: premiumization. Younger generations may not be drinking wine, but older generations are—and they’re drinking more of it every year. In 2022, consumers over 60 were the only group driving volume growth, with the largest growth happening amongst 70–80-year-olds.

Not only are only older Americans drinking more wine, but they’re also trading up. In line with the premiumization trend seen in spirits, wine drinkers are willing to pay more for premium bottles of vino. Higher-priced wines like Josh Cellars, typically starting at $20, were the industry’s growth drivers in 2022, whereas lower-priced brands like Barefoot and Franzia continued to drop in sales.

Canned Continues to Climb

Much like the spirits industry, the wine industry has witnessed a remarkable surge in the popularity of ready-to-drink (RTD) beverages and canned wines in recent years. According to a report from Grand View Research, the global canned wine market size is forecast to be valued at nearly $600 million by 2028, expanding at a compound annual growth rate of 13.2%.

These new products have successfully tapped into the changing preferences of today’s wine enthusiasts, even drawing in younger consumers whose drink of choice may not be a traditional full-bodied cabernet. The younger generation embraces RTD wines for the same reason they do RTD spirits: they are convenient, affordable, diverse, and offer a more casual and on-the-go drinking experience. They also cater to the evolving tastes and dietary preferences of health-conscious consumers, providing options that are low in calories and sugar.

There are some product-based benefits to canned wine, as well. When packaged in aluminum cans, wine is no longer susceptible to UV light penetration or oxygen exchange, resulting in a much longer shelf life—benefitting retailers who have been coping with out-of-stocks and supply chain issues for a few years now.

As we continue to see smaller and newer categories like canned wine rising in sales, suppliers, distributors, and even retailers can seize these opportunities to grow sales and market share.

Bring out the Bubbly

While sparkling wine was previously only brought out on special occasions, in recent years it has become increasingly popular for everyday consumption. With a shift in consumer attitudes towards this category, more people are now enjoying bubbly drinks regularly. Whether it’s in a favorite brunch drink, a viral cocktail spritzer, or simply on its own, sparkling wine has become a versatile beverage that’s perfect for any occasion—especially on-premise. Drinks like prosecco and cava have become increasingly popular for their accessible price point, taste, and even pronunciation. Like still wines, younger consumers are often less willing to trade up for Champagne and other premium sparkling wines, but due to the low-sugar and low-alcohol nature of the drink, they are still the ones driving the demand for other products in the category.

According to International Wine and Spirits Research, sparkling wine is the only segment to experience significant growth in volumes sold between 2016-2021. The market report also found that the number of Americans enjoying sparkling wine has grown by 30% between 2019 and 2022—and that’s definitely something to celebrate.

E-Premise: The Newest Environment

During the pandemic-impacted year of 2020, sales on alcohol e-commerce sites like Drizly and Saucey skyrocketed, with Drizly seeing a 350% year-over-year sales increase.

For wine suppliers and distributors, however, this was nothing new. Before 2020, online wine sales had already been well-established in the industry and enjoying a market advantage for some time. Wine clubs and subscription services have been around for years and are a favorite of wine lovers for their convenience and variety, providing a selection of wines based on the purchaser’s input and preferences.

The reason why wine has been able to enjoy a market advantage in e-commerce for so long is due to the strict regulations of online alcohol sales in the United States. There are many carve-outs in state laws that prevent the digital sales of beers and spirits but allow wine to be shipped within states and across state lines. Because of this, the wine industry continues to represent a massive portion of online alcohol sales, even after the spirits boom of 2020. In 2022, wine sales represented 62% of total alcohol e-commerce sales—an equivalent of $3.8 billion.

Winning the Wine Market

While there are some headwinds in the wine industry as a whole, new product categories, premiumization, and a continued advantage in the e-commerce space offer some optimism for suppliers and distributors. To thrive in the fast-paced environment of Beer, Wine, and Spirits, adaptability and innovation are key—and brands need to track not only their positioning and execution, but their competitors as well.

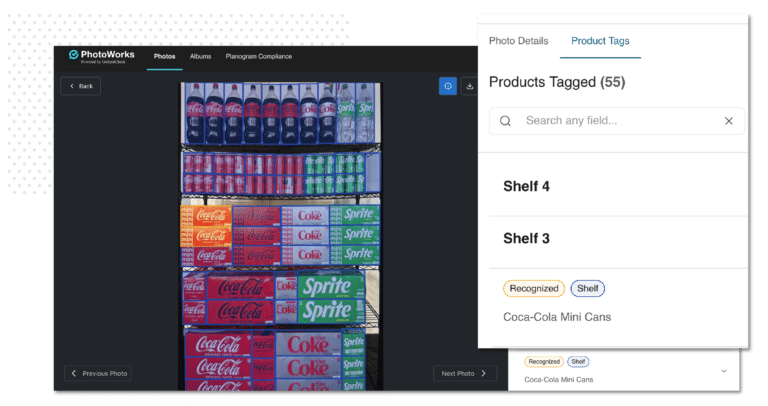

With FORM’s Image Recognition AI, wine suppliers and distributors can improve rep performance and get better insights—with one app. Our powerful computer vision AI can detect and analyze wine on shelves, back bars, and even menus to enable teams to save time, track execution, and boost category share. Curious how it works? Take an interactive product tour here, and check out more resources on our Image Recognition technology here.